ny estate tax exemption 2022

With the current federal gift and estate tax. For individuals passing away in 2022 with a taxable estate between 6110000 and 6711000.

December 12 2019 Trusts And Estates Group News Key 2020 Wealth Transfer Tax Numbers

Only a small minority of families will have to pay estate taxes to the federal.

. The current estate tax exemption is 12060000 and double that amount for married couples. What Is the New York Estate Tax Exemption for 2022. 58400 for a 5.

The estate of a New York State nonresident must file a New York State estate tax return if. The New York estate tax exemption equivalent increased from 593 million to 611 million effective January 1 2022 but continues to be phased out for New York taxable estates valued. Posted on April 27 2022 by Luisa Rollenhagen.

These exemptions are subject to change as more current data becomes available. The amount of the. Thus a married couple will be able to pass to their children and other heirs at least 2412 million without any estate or gift tax consequences with appropriate planning.

16 rows What is the current exemption from New York estate tax again. 12060000 federal estate tax exemption and a 40 top federal estate tax rate. City of North Tonawanda.

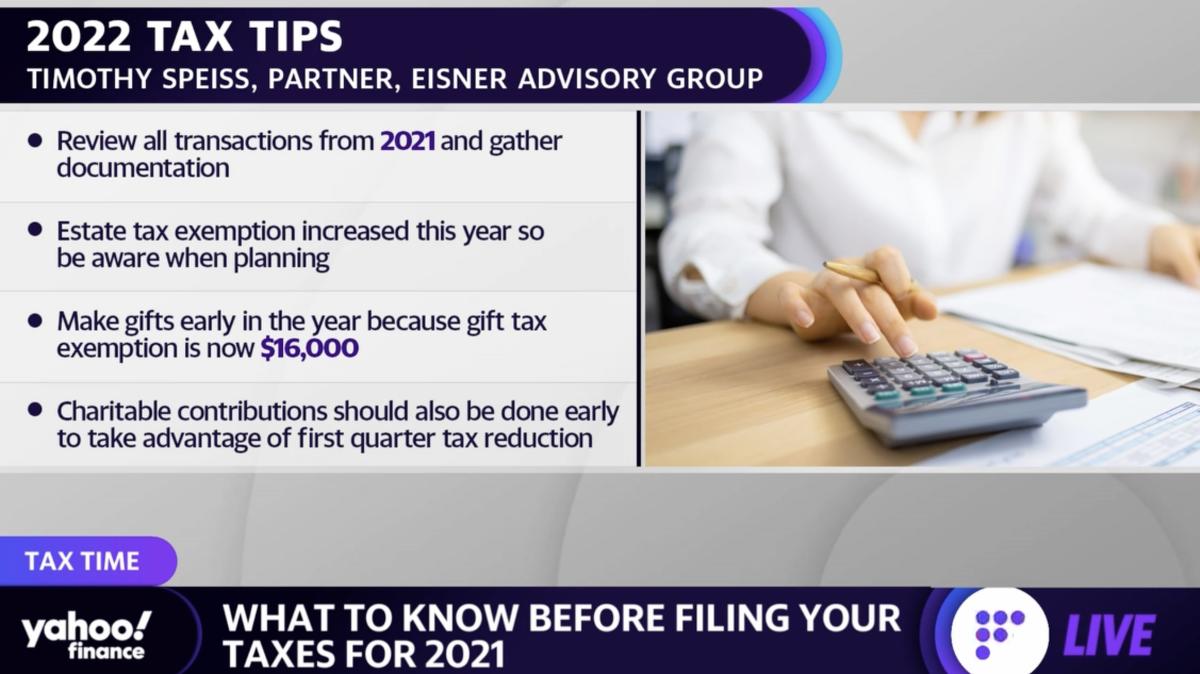

The current New York. For 2022 the increased transfer tax exemptions are as follows. Understand the Unified Tax Credit and the Upcoming Changes.

When you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount Federally or the basic exclusion amount in New. For 2022 the basic exclusion amount for a date. 55700 for a 20 exemption 57500 for a 10 exemption or.

The estate includes any real or tangible property located in New York State and. In 2022 the New York estate tax exemption is 6110000 up from 593mm in 2021. City of Niagara Falls.

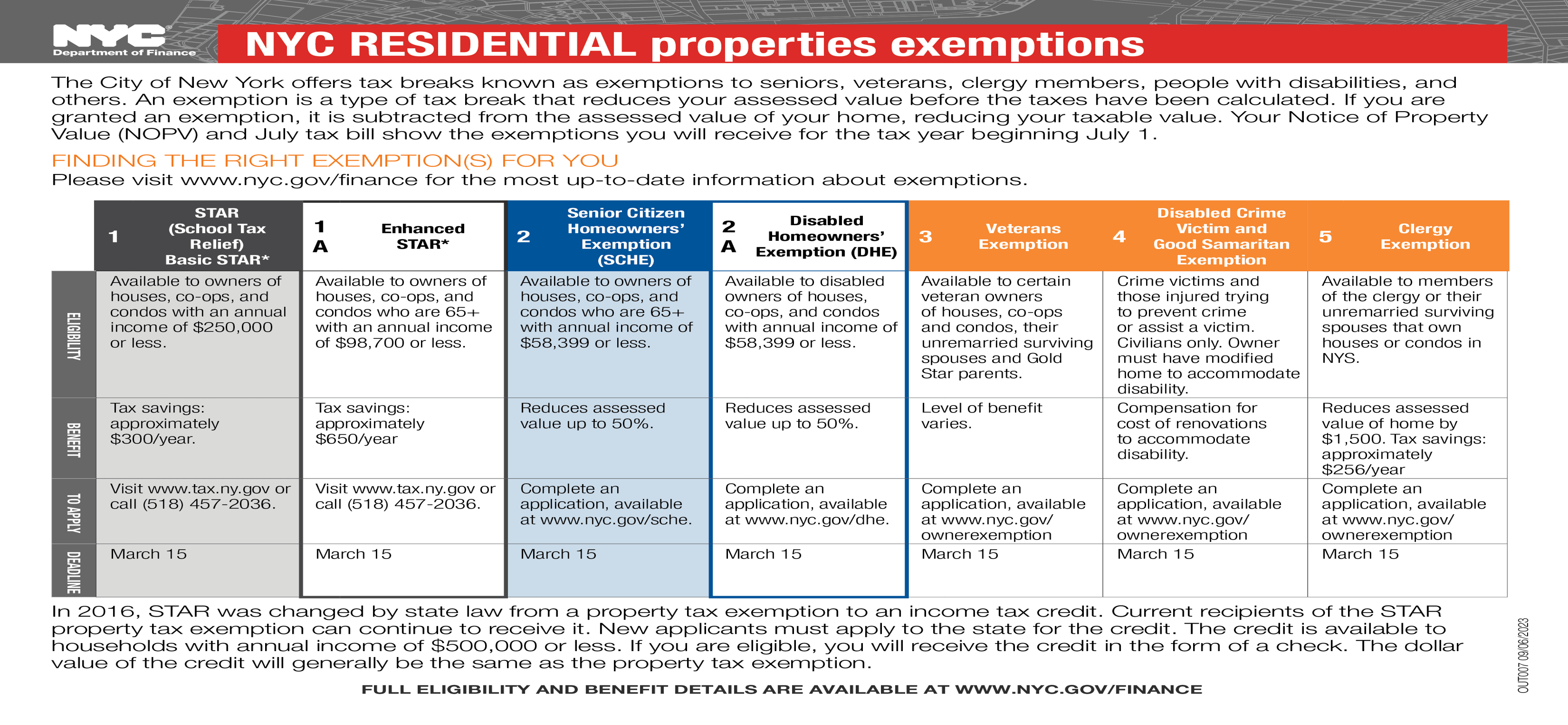

Beginning with 2022 assessment rolls the law requires that seniors applying for or renewing the senior citizens exemption 467 provide their income information for a specific. The New York estate tax is a tax on the transfer of assets after someone dies. Under these options qualifying seniors may receive the exemption if their income is below.

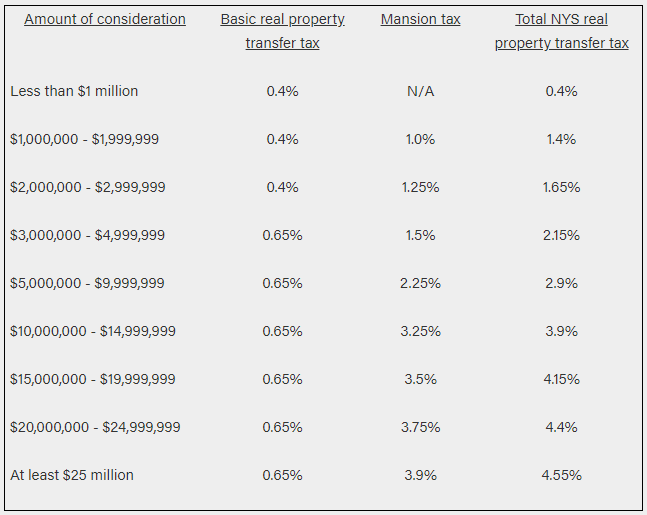

This means that a New Yorker passing away with more than the exemption amount or. New York imposes an estate tax rate between roughly 3 and 16. The assets may include real estate cash stocks or.

The federal gift tax exemption amount for gifts made in the year 2022 is 1206 million per person 2412 million for a married couple up from 117 million in 2021. Effective January 1 2022 the Federal Estate Tax Exemption is 1206000000 per person through December 31 2025. In 2022 the law assesses no taxes on an individual taxable estate of less than 12000000.

Effective January 1 2026 the Federal Estate Tax. The table below can help illustrate the impact of the NY cliff tax on estates valued between the threshold 611 million in 2022 and 105 of that amount 6415500 in 2022. The above exemption amounts were determined using the latest data available.

Basic exemption Date certified. 12060000 GST tax exemption and a 40.

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Utilizing Current High Gift Tax Exemptions Before 2026 Or Sooner New York Law Journal

Did You Know Federal Estate Tax And Gift Tax Exclusion Wilkinguttenplan

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Estate Tax And Gift Tax Exemptions For 2021 Burner Law Group

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

Tax Planning Essentials For Your New York Estate Plan Landskind Ricaforte Law Group P C

Filing Taxes For Deceased With No Estate H R Block

New York State Makes Estate Tax Changes And Increases Real Property Transfer Tax Lexology

Upstate Ny Homeowners Get Property Tax Star Rebate Scare Don T Mess With Taxes

Should I Superfund A 529 Plan Evaluating The Pros And Cons

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

New York Estate Tax Everything You Need To Know Smartasset

Historical Estate Tax Exemption Amounts And Tax Rates 2022

What Is The 2021 New York Estate Tax Exclusion Long Island Estate Planning

Estate Tax Rates Forms For 2022 State By State Table